"Making Informed Decisions: A Closer Look at Novated Leases and Salary Sacrifice" Fundamentals Explained

The Pros and Cons of Novated Leases and Salary Sacrifice

Novated leases and compensation sacrifice are two well-liked options when it comes to acquiring a motor vehicle. Both procedures supply certain perks and downsides, which individuals require to carefully think about just before making a selection. In this post, we will certainly look into the pros and cons of novated leases and wage reparation to aid you create an informed choice.

Novated Lease

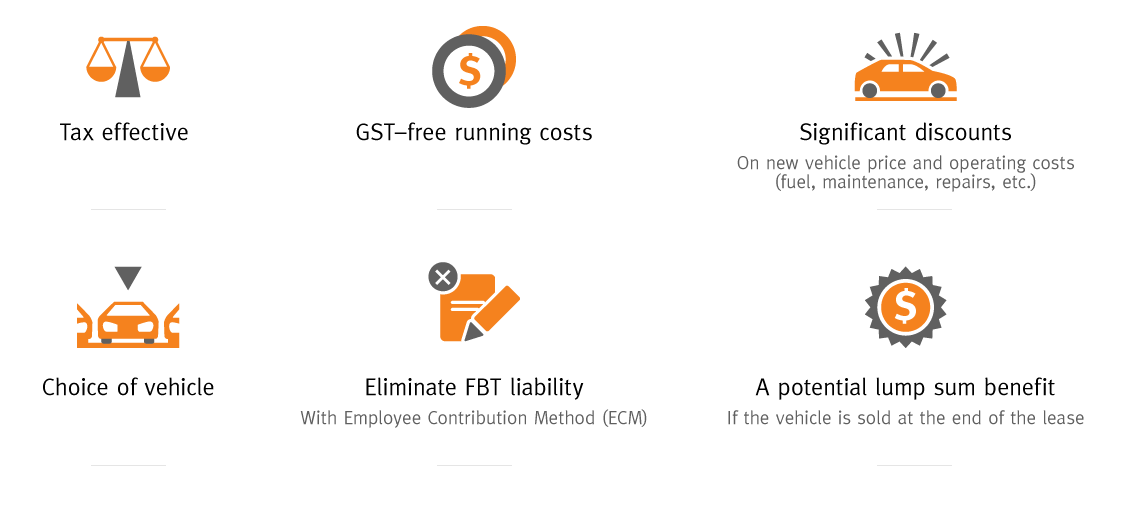

A novated lease is an agreement between an employee, their employer, and a financial company. It permits workers to lease a lorry utilizing pre-tax revenue, therefore reducing their taxable earnings. Here are Check it Out and drawbacks of novated leases:

Pros:

1. Income tax perks: One significant conveniences of novated leases is the tax obligation financial savings they offer. As lease settlements are subtracted coming from pre-tax earnings, employees may potentially decrease their taxable income and pay for much less tax.

2. Comfort: Novated leases offer convenience in phrases of budgeting for vehicle-related expenditures. The lease payments generally deal with all expense linked with the cars and truck, including sign up fees, insurance premiums, gas costs, solution expenditures, etc.

3. Versatility: Yet another advantage is the flexibility in opting for your auto. Along with a novated lease, you have more choices reviewed to conventional car finances since you can easily opt for any sort of make or version that accommodates within your finances.

Downsides:

1. Loss of possession: When entering into a novated lease agreement, you don't have the lorry outright unless you determine to buy it at the end of the lease phrase or re-finance it.

2. Restricted use: Novated leases typically come along with constraints on mileage restrictions or utilization health conditions set by employers or financial companies.

3. Company engagement: Since employers are included in these arrangements, any type of adjustments in work status may affect the lease setup.

Salary Sacrifice

Compensation sacrifice is another option for obtaining a automobile where an staff member concurs to forego component of their compensation in exchange for non-cash perks, such as a motor vehicle. Let's look into the pros and downsides of salary sacrifice:

Pros:

1. Tax savings: Comparable to novated leases, earnings sacrifice enables employees to lessen their taxed revenue through helping make pre-tax additions in the direction of the vehicle.

2. Possession: Unlike novated leases, along with compensation sacrifice, you have the option to own the motor vehicle outright from the beginning.

3. Versatility: Wage reparation offers flexibility in terms of car variety, making it possible for you to decide on any make or design that fit your choices and spending plan.

Downsides:

1. Minimal choices for expenditures: While novated leases deal with all car-related expenses, earnings sacrifice agreements may only deal with specific costs linked with the car.

2. Reduced take-home wages: Deciding for income reparation means taking a cut in your take-home income since you are giving up component of your wage towards the auto.

3. Employer involvement: Similar to novated leases, employers are entailed in salary reparation contracts, which implies any kind of changes in work status can easily affect the plan.

In conclusion, both novated leases and earnings reparation give specific perks and disadvantages that people need to think about just before choosing which alternative is greatest for them. Novated leases supply tax perks and benefit but happen along with restrictions on ownership and utilization. On the various other hand, earnings sacrifice offers tax savings and ownership chances but may have restrictions on expense coverage and decreased take-home salary. It is essential to carefully consider these pros and disadvantages before helping make a choice on how to obtain your following car.

Note: Word count - 489 words